We attended a Focus Group regarding generational wealth building, and one question asked was, “Are Wealth Building and Estate Planning the same thing”? The surprise was the amount of banter in both directions. Answers ranged from they’re not the same to they are the same thing. The most provocative misconceptions of estate planning are that you can have either just not both.

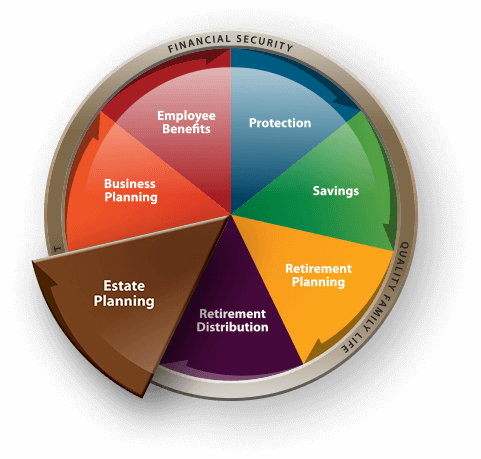

Let’s first set the stage for the two disciplines. Estate planning is the process of gathering any assets you have, such as any financial accounts, real estate, and heirlooms, and planning how you will distribute those assets to your beneficiaries. Estate planning helps you set yourself and your loved ones up for success if/when anything happens to you. Wealth building is the strategic process of generating long-term financial security by accumulating assets and minimizing debt. The goals are to protect and increase one’s net worth. It is a journey that primarily involves earning, saving, and investing. Most importantly, protecting your money consistently over time.

Misconceptions of Estate Planning Demystified

In reality, people use Estate Planning as another pillar to build generational wealth.. Purchasing a home is one of the largest investments that most people make. Real Estate is the one investment you can always rely on to appreciate in value. Real estate planning is an essential component of estate planning. It is the comprehensive process of managing and arranging your assets and affairs to ensure you carry out your wishes.. This needs to happen during your lifetime and after your death. Here are some of the most common misconceptions about estate planning.

- 1. Estate Planning is for the Wealthy

- 2. Estate Planning is for the Elderly

- 3. Assets will automatically pass to heirs

- 4. There will NOT be the need to Probate the estate

- 5. I’m too young to consider Estate Planning

This process is crucial for everyone, not just the wealthy, as it provides peace of mind. Planning also helps avoid legal hurdles and family disputes. The estate planning process involves a series of steps and key legal documents. Those documents design to manage and transfer your assets, address healthcare wishes. Equally important are they provide for loved ones during your lifetime and after death.

We have the expertise and the resources necessary to plan your estate. Results are that what you leave is adequately provided for. Amassing fortunes and passing them to survivors as close to tax-free won’t happen in a vacuum. Proper estate planning ensures your legacy will continue working for your survivors just like it worked for you.

![]()